2024-25 New South Wales Budget

On Tuesday 18 June 2024, Treasurer the Hon Daniel Mookhey MLC – delivered the 2024-25 NSW State Budget.

The Minns’ Government’s budget is set in an environment where household budgets are under pressure. Inflation has continued to ease over the past year but remains too high. Growth in the price of essentials continues to outstrip discretionary items. Inflation, increasing mortgage repayments, and tax bracket creep are all straining household budgets.

In this budget, Labor continues its plans to remove the wages cap, reform tolls, provide further support to first-home buyers, build new and better public schools and hospitals, speed up the rollout of renewables, rebuild rural and regional roads, help small businesses, and manage the State’s debt.

The 2024-25 NSW Budget can be found here.

The Treasurers Budget Address can be found here.

Budget Outlook

Inflation has continued to ease over the past year, easing pressure on interest rates and helping to address cost-of-living pressures. However, inflation remains high with growth in the price of essentials continuing to outstrip discretionary items. Elevated inflation, high interest rates and tax bracket creep have offset the strong growth in labour income over the last year, curbing household spending. This has seen domestic economic growth slow sharply on a per capita basis.

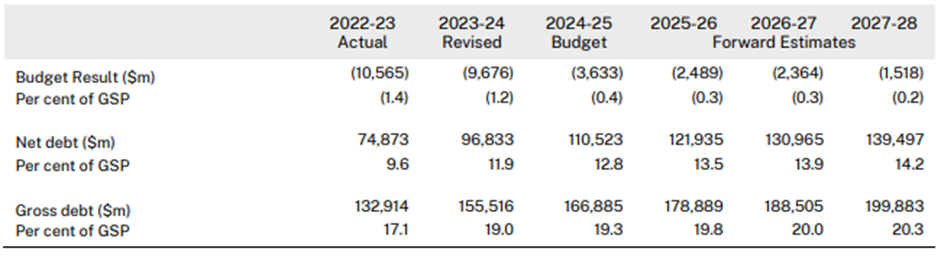

The 2024-25 Budget projects a deficit of $3.6 billion in 2024-25, down from the $0.5 billion surplus projected in the 2023-24 Half-Yearly Review. Changes to GST relativities, weaker payroll tax, and higher depreciation and interest costs have contributed materially to this deterioration, alongside essential new funding to alleviate cost-of-living pressures and rebuild essential services.

Across the forward estimates, deficits are projected to reduce. The Government is expected to return to a net cash operating surplus in 2024-25, for the first time in three years. Since the 2023-24 Half-Yearly Review, total general government sector revenue is forecast to be $5.1 billion higher over the four years to 2026-27 as the reduction in GST and payroll tax revenue is netted out by improved stamp duty and land tax projections.

Total general government sector expenses are projected to increase from $120.5 billion in 2023-24 to $129.1 billion in 2027-28, growing at an average rate of 1.7 per cent per year, well below the average expense growth from 2018-19 to 2022-23 of 9.7 per cent.

Key Budget Aggregates – General Government Sector

2024-25 Budget Commitments

Housing and Planning

- The Transport Oriented Development Program:

- Rezones areas around eight train and metro stations as priority precincts for more housing, supported by $520.0 million in new infrastructure

- Rezones areas around 37 train and metro stations across greater Sydney to increase midrise housing in well-connected locations

- This Budget invests an additional $555.5 million to speed up the planning system and construct more housing enabling infrastructure. This includes:

- $253.7 million to bolster the State’s planning system, including to assess more development applications and deliver additional State-led rezonings

- $246.7 million for enabling infrastructure, conservation activities and land acquisitions to accelerate the delivery of more housing in Western Sydney and across the regions

- $35.0 million for the NSW Building Commission to support its ongoing efforts to reform the building and construction industry and improve consumer outcomes

- $5.0 million for preliminary design and planning works to support the future redevelopment of Bays West around the Bays Metro station and White Bay Power Station

- This Budget includes $200.0 million for the Faster Assessments program to incentivise councils to meet and exceed their targets by providing grants for infrastructure that supports housing

Building Homes for NSW

- The Budget includes $5.0 million to continue the audit of surplus NSW Government land

- This Budget invests $5.1 billion in 8,400 social homes, of which 6,200 will be new homes and 2,200 are replacement homes

- This program also invests $1.0 billion to repair 33,500 existing social homes

- The Budget includes $655.1 million for key worker and rental housing:

- $450.0 million for a Key Worker Build-to-Rent Program to be delivered by Landcom across metropolitan areas of the State

- $200.1 million for key health worker accommodation across rural and regional areas of the State

- $5.0 million for Landcom to deliver an additional 10 Build-to-Rent dwellings in Bomaderry, with 60 homes now to be delivered through a total Government investment of $35.0 million.

- This Budget also includes an additional $8.4 million for the Rental Commissioner to develop and enforce renter protections.

- Supporting the growing number of renters in apartments with an expanded Strata and Property Services Commissioner to regulate strata schemes for $11.8 million

- $527.6 million for emergency housing and homelessness support services, which includes:

- over $260.0 million to help people and families who need safe shelter with crisis accommodation and support to move to more stable housing

- over $250.0 million of funding to support people who are homeless or at risk of homelessness, including those leaving correctional centres and mental health services and securing funding for Specialist Homelessness Services and the Aboriginal Community Controlled sector for homelessness services.

Transport

Investment in transport in the 2024-25 budget includes:

- $2.1 billion for delivery of the Paramatta Light Rail Stage 2, paving the way for construction to start.

- $13.4 billion will be provided for continuation of Sydney Metro West, this will potentially include an additional station in Rosehill.

- $5.5 billion for delivery of the Western Sydney Airport Metro and $1.2 billion for Sydney Metro City and Southwest

- $1.9 billion for a new zero-emissions bus fleet.

- In response to recommendations from the Bus Industry Taskforce, $91.0 million has been allocated to the Bus Transport. Management System which will replace the current legacy system

- The Tangara fleet will be upgraded and extended for an additional 12 to 15 years, at a cost of $447.0 million.

Roads

This Budget allocates $1.0 billion in 2024-25, bringing the total program to $5.2 billion, including matched funding from the Australian Government. The Government is also increasing road safety funding across metropolitan, regional, and rural areas of the State by $290.0 million. This brings the total investment to $2.8 billion to build safer roads and reduce fatalities.

- In Sydney this is outlined by:

- Upgrade Mamre Road Stage 2 between Erskine Park and Kemps Creek for $1.0 billion

- Widen Elizabeth Drive with four lanes connecting Mamre Road and The Northern Road to the airport for $800.0 million

- Widen for Richmond Road – M7 to Townson Road for $520.0 million

- Upgrade Garfield Road East for $276.3 million

- Upgrade Memorial Avenue from Old Windsor Road to Windsor Road for $48.2 million

- Add a separated four-lane dual carriageway on Mulgoa Road Stage 2 between Glenmore Park and Jeanette Street for $230.0 million

- Upgrade the intersection at St Johns Road and Appin Road for $45.0 million.

- Regional communities receive:

- $350.0 million for Inland Rail Level Crossings at Parkes and Narrabri

- $275.0 million for Nelson Bay Road to Bob’s Farm

- $130.0 million for the Avoca Drive upgrade

- $105.0 million for Nowra Bypass and Network Planning

Health

- The NSW Government’s Emergency Department Relief Package invests $480.7 million to help to avoid an estimated 290,000 visits to emergency departments each year once fully implemented.

- The $130.9 million Family Start Package provides early intervention programs to boost lifelong maternal and child health.

- $274.7 million Essential Health Services Fund, to help recruit 250 new healthcare workers to new hospitals across the state. This funding will also support rising costs of providing healthcare services in hospitals and increasing activity in the health system and will improve patient care and wait times.

- The Building Better Hospitals Package commits $265.0 million for a critical upgrade of Port Macquarie Hospital and an additional $395.3 million to deliver ongoing hospital redevelopments at Eurobodalla, Ryde, Temora, Mental Health Complex at Westmead, Liverpool, Moree, Nepean, Cessnock and Shellharbour.

- A further $250.0 million will be invested across NSW hospitals as part of the Critical Asset Maintenance Program. Development also continues for the new Single Digital Patient Record system which will improve care and access to timely treatment and patient information.

- $200.1 million expansion of the NSW Health Key Worker Housing Accommodation program.

Education

- The NSW Government is delivering 100 public preschools, with sites having been chosen and the first at Gulyangarri Public School set to open later this year. The NSW government are also investing $60.0 million in new and upgraded non-government preschools.

- Other investments include:

- An additional $481.1 million for public education in NSW.

- The 2024-25 Budget invests $8.9 billion in the Rebuilding Public Education Program.

- $1.0 billion in funding for school maintenance and minor upgrades will work through the multi-year backlog of works previously promised to schools but not delivered.

- The NSW Government is also planning to build better communities, including ensuring jobs and training opportunities are accessible across NSW.

- $190.2 million to undertake urgent repairs at campuses across the State and improve Wi-fi at campuses across the State.

- $83.1 million to support increased permanency within TAFE NSW through the conversion of 500 casual teachers into permanent employment.

- An additional $8.9 million, to bring total expenditure up to $16.3 million, for Fee Free training for all apprentices and trainees in NSW.

Better Protection for Victim-Survivors of Domestic and Family Violence

This Budget provides $245.6 million over four years for a coordinated, multi-pronged response that seeks to disrupt the cycle of domestic and family violence early and permanently, while optimising crisis response services to support victim-survivors.

The 2024-25 Budget includes the following support in this area:

- $48.1 million to secure funding for specialist workers who support children accompanying their mothers to refuges, expanding their presence from 20 to 30 refuges across New South Wales

- $48.0 million to roll out the Staying Home Leaving Violence program state-wide and to expand the Integrated Domestic and Family Violence Service

- $45.0 million to improve bail laws and justice system responses to domestic violence

- $38.3 million to implement NSW’s first dedicated Domestic, Family and Sexual Violence Primary Prevention Strategy, which will fund a range of initiatives to address the drivers of gendered violence

- $29.6 million for the Women’s Domestic Violence Court Advocacy Service to provide support for victim-survivors requiring support to navigate the justice system

- $10.0 million to support Men’s Behaviour Change Programs to enable men to recognise their violent behaviour and develop strategies to prevent the use of violence

- $13.6 million for research into perpetrators and effective interventions, workforce training on the implementation of a newly developed risk assessment framework, and expanding Domestic Violence NSW, which is the peak body for specialist services in New South Wales.

- Of the 6,200 net new social homes that will be built as part of the “Building Homes for NSW program, at least 50 percent will be prioritised for victim-survivors of domestic and family-violence.

Better Support for our Community

The 2024-25 Budget provides $5.1 billion to build social homes, including 8,400 social homes, of which 6,200 will be new homes and 2,200 are replacement homes (with priority homes for victim-survivors of domestic and family violence).

- This program also invests $1 billion to repair 33,500 existing social homes. The Government will provide $655.1 million for key worker and rental housing, including:

- $450.0 million for a Key Worker Build to Rent Program to be delivered by Landcom across metropolitan areas of the State

- $200.1 million for key health worker accommodation across rural and regional areas of the State.

- This Budget provides $555.5 million to speed up the planning system and construct more housing enabling infrastructure, including:

- $253.7 million to bolster the State’s planning system, including to assess more development applications and deliver additional State-led rezonings

- $246.7 million for enabling infrastructure, conservation activities and land acquisitions to accelerate the delivery of more housing in Western Sydney and across the regions. The 2024-25 Budget also invests in a better system for renters, including:

- $11.8 million to support the growing number of renters in apartments with an expanded Strata & Property Services Commissioner to regulate strata schemes

- $8.4 million for the Rental Commissioner to develop and enforce renter protections.

- This Budget also provides $527.6 million for emergency housing and homelessness support services, including:

- $260.0 million to provide homeless people and families who need safe shelter with crisis accommodation and support to move to more stable housing

- $250.0 million for funding to support people at risk of homelessness, including those leaving correctional centres and mental health services.

Our Regions, Energy and Environment

- The Minns Labor Government is building better communities in regional NSW by making additional investments in mine safety and rehabilitation in the 2024-25 NSW Budget.

- $37.7 million to support regional communities and protect workers.

- In addition, the Government is continuing to contribute $22.5 million to a statutory fund to support coal-producing communities for a future beyond coal.

- The Minns Labor Government is building better communities by investing a total of $3.5 billion in Climate Change and Energy in the 2024-25 Budget, to ensure we have the reliable, secure energy system we need.

- The Minns Labor Government is taking action to help NSW households save on their energy bills by allocating $238.9 million in the 2024-25 Budget for the forthcoming Consumer Energy Strategy.

- The 2024-25 Budget also includes:

- $128.5 million over two years to upgrade roads and infrastructure, from the Port of Newcastle to Renewable Energy Zones in regional NSW, to enable the transportation of critical components required for the construction of renewable energy infrastructure. The components include wind turbine blades, batteries and transformers.

- $435.4 million in 2024-25, including a boost of $100 million, to increase the value of energy bill rebates to assist households with the cost of living. The investment also includes $10 million to launch a pilot program providing debt relief for people in critical need.

- $15.8 million is being allocated to make our energy system safer, more reliable and better equipped to manage an increase in the number of households investing in new energy saving technologies.

- $87.5 million over four years to make energy saving upgrades to social housing properties, to keep homes warmer in winter and cooler in summer.

- $39.3 million over seven years to speed up biodiversity assessments for crucial renewable energy and housing projects. This will support the NSW Government’s housing and emissions reduction targets.

- Funding to create the Energy Security Corporation, which will be seeded with $1 billion to accelerate private sector investments in clean energy projects, to improve the reliability, security and sustainability of electricity supply.

- The 2024-25 Budget includes a total of $2.4 billion for the Environment and Heritage Portfolios. Investments include:

- $75.1 million to maintain our national parks to protect our environment, boost nature based tourism and encourage more people to explore the almost 900 parks and reserves across NSW. This builds on last year’s $74.4 million to upgrade visitor infrastructure, which has delivered new and improved walking paths, camping grounds, lookouts and picnic facilities.

- $43 million for the Environment Protection Authority to boost the transformation of the waste and recycling industry in NSW. This funding will provide grants to expand our capacity to recycle plastics and organics and to support other strategic waste infrastructure initiatives.

- $87.5 million for the Environmental Trust to provide grants to industry, state and local government, community groups and Aboriginal and research organisations undertaking projects focusing on restoration and rehabilitation, education, research and waste activities.

Supporting Businesses and Protecting Consumers

The NSW Government’s commitment to assisting small business will continue in the 2024-25 Budget. The recently created Service NSW Business Bureau has been allocated an additional $5.0 million, bringing the total investment in 2024-25 to $30.0 million.

- $11.4 million for the low and mid-rise Housing Pattern Book and design competition.

- $35.0 million for the NSW Building Commission supports its efforts to assure new homebuyers of the quality of their build.

- $188.8 million to the Bulk-Billing Support Initiative will protect the cost of seeing a GP and reduce the strain on our emergency departments.

- $205.0 million for cyber security and ID Support NSW to build cyber resilience and help people affected by a data breach.

- $62.5 million to roll out digital licensing to 80 NSW qualifications, making applications faster and more convenient.

- $21.4 million to help build a NSW Digital ID and Wallet to make proving your identity and qualifications easier and more secure.

Disaster Relief and Recovery

- $5.7 billion, including co-contributions from the Australian Government, to continue natural disaster support and recovery programs. This includes:

- $3.3 billion for restoration works to repair local and State roads damaged in major flood events, including in the Northern Rivers and Central West.

- $632.4 million to continue delivering new and safe housing across the Northern Rivers and Central West, including $525.0 million to support voluntary buybacks, raisings, repairs and retrofits through the Resilient Homes Program.

- $303.5 million to repair and rebuild water, sewerage, and community infrastructure, and improve the resilience of infrastructure for future disasters.

- $94.7 million for critical resources in flood rescue coordination, operational enhancements, and fleet expansion. This will help to fulfil recommendations made in the 2022 flood inquiries and mitigate the impact of future floods and natural disasters on NSW communities.

- $6.5 million for the Spontaneous Volunteers Support Program to support better coordination of community efforts to save lives and property during disasters.

- Enhancing our emergency response

- $189.5 million increased funding for 286 existing firefighters who did not have ongoing funding in previous budgets.

- $15.4 million to establish a new 24-hour fire station at Badgerys Creek ahead of the opening of the new Western Sydney Airport.

- $2.4 million for the state-wide Disaster Response Legal Service, the only specialist disaster legal service in NSW.

Building Better Communities

- Community harmony

- $88.8 million to the NSW Office of Sport to support grassroots sports in new communities, deliver women’s sport initiatives and planning for the relocation of the NSW Institute of Sport ahead of the Olympic Games.

- $73.0 million in a permanent boost in funding to support social cohesion and community harmony through Multicultural NSW.

- $6.0 million over two years to continue the Learn to Swim program targeted at Culturally and Linguistically Diverse and low socioeconomic communities.

- $10.0 million to continue gambling harm minimisation programs which support people and minimise their risk of harm.

- First Nations: The 2024-25 Budget continues the NSW’s Government’s support for First Nations people and communities, including:

- $202.6 million for the maintenance of social housing needing urgent repair for First Nations communities across NSW, as part of the Building Homes for NSW program.

- $73.4 million to establish Keeping Places at the sites of former children’s homes, to support reconciliation with Stolen Generations survivors.

- $37.8 million for the Government’s obligations under Indigenous Land Use Agreements entered into with native title holders.

- $21.3 million for the Waminda Gudjaga Gunyahlamai Birth Centre and Community Hub in Nowra.

- $202.6 million for the maintenance of social housing needing urgent repair for First Nations communities across NSW, as part of the Building Homes for NSW program.

- $73.4 million to establish Keeping Places at the sites of former children’s homes, to support reconciliation with Stolen Generations survivors.

- $37.8 million for the Government’s obligations under Indigenous Land Use Agreements entered into with native title holders.

- $21.3 million for the Waminda Gudjaga Gunyahlamai Birth Centre and Community Hub in Nowra.

- $16.3 million to deliver Aboriginal Cultural Heritage reforms to recognise and conserve sites of cultural significance.

- $9.2 million to conduct on-site assessments of the infrastructure, contaminant and housing needs in 61 Discrete Aboriginal Communities across the State.

- $5.0 million to undertake consultation to determine a pathway to treaty with First Nations communities.

- Night-time economy: $54.2 million to rebuild the night-time economy and creative industries, including:

- $26.9 million for the Office of the 24-Hour Economy Commissioner to empower the night-time economy and local councils through regulatory reform, grants programs, precinct-based initiatives, digital tools and other support for create diverse, safe, and vibrant communities across NSW.

- $18.5 million for the Sound NSW election commitment to deliver programs that drive audience and international market development, strengthen the live music ecosystem and champion NSW artists and stories.

- $8.8 million for further critical upgrades at our cultural institutions (Sydney Opera House, State Library of NSW, Sydney Observatory, Powerhouse and Australian Museum) after a decade of neglect.

Cost of Living Relief

- Boosting bulk billing

- $188.8 million Bulk-Billing Support Initiative will protect the cost of seeing a GP and reduce the strain on our emergency departments. The initiative will ease financial pressure on GP practices by waiving historical payroll tax liabilities for contractor GPs and provide an ongoing tax rebate to clinics that meet bulk-billing thresholds.

- Energy rebates

- The expanded energy social program, which includes an increase of $100.0 million in 2024-25, will support up to 1 million NSW households with the cost of living, and brings the total program for 2024-25 to $435.4 million.

- From 1 July 2024 the Family Energy Rebate and the Seniors Energy Rebate will increase to $250, and the Low-Income Household Rebate, the Medical Energy Rebate will increase to $350. The Life Support Rebate will be up to $1,639 for each equipment type.

- Supporting motorists on Sydney’s privatised toll roads

- $561.0 million over two years to continue the $60 toll cap that began on 1 January.

- Better pay

- Building on the Government’s 4.5 per cent wage offer of 2023-24, the 2024-25 Budget provides for a 10.5 per cent wage increase (including superannuation) over three years to benefit the more than 400,000 NSW public sector workers.

- Housing

- Concessions and exemptions from transfer duty on properties valued less than $1.0 million for eligible first home buyers under the First Home Buyer Assistance Scheme which was expanded on 1 July 2023.

- A $10,000 First Home Owner Grant for eligible first home owners buying a newly built house, townhouse, apartment, unit or similar with a purchase price below $600,000 or land and new house with a total combined cost below $750,000.

- Private rental assistance through Rent Choice, Advance Rent, Bond Loan and other programs to help eligible persons, including those escaping domestic violence, set up and maintain a tenancy in the private rental market.

- The Pensioner Council Rates Concession provides a rebate of up to $250 on ordinary council rates and charges for domestic waste management services to eligible pensioners, jointly funded by councils.

- Energy and Water

- The low Income Household Rebate provides up to $350 per year off the electricity bills of certain Commonwealth concession card holders.

- Helping eligible people who receive the Family Tax Benefit to pay their electricity bills through the Family Energy Rebate of up to $250 per year.

- The NSW Gas Rebate provides up to $110 per year off the gas bills of certain Commonwealth concession card holders.

- Assisting self-funded retirees who hold a valid Commonwealth Seniors Health Card with the cost of energy through the Seniors Energy Rebate of $250 per year.

- The Medical Energy Rebate of up to $350 per year for eligible concession holders with medically diagnosed inability to self-regulate their body temperature in extreme environmental temperatures.

- The Life Support Rebate provides annual assistance of up to $1,639 per equipment type for people who need to use approved energy-intensive life support equipment at home.

- Education

- To support families with young children with the cost of living, the NSW Government will continue to provide up to $4,220 per year in fee relief for parents and carers of 3–5-year-olds in community and mobile preschools. In addition, $500 – $2,110 in fee relief is available to parents and carers of children aged 3 – 5 years attending eligible preschool programs in long day care centres. It is estimated that over 200,000 enrolments will be eligible for NSW Government fee relief in 2024.

- Fee-free training for the formal training component of apprenticeships and traineeships.

- Subsidised vocational education training for in-demand skills and industries and fee concessions for Commonwealth welfare beneficiaries and people with a disability through the Smart and Skilled program.

- The Vocational Training Assistance Scheme travel and accommodation allowance for apprentices or new entrant trainees who are required to travel more than 120 km round trip to attend day or block-release training.

- Bert Evans Scholarships for apprentices in NSW who are facing hardship in their personal circumstances but demonstrate a capability for vocational education and a positive attitude in their training and workplace.

- Recreation

- Two $50 Active and Creative Kids combined vouchers for eligible families available twice a year at the start of Term 1 and Term 3 to enable kids to participate in sports, recreation, cultural or creative activities.

- Free or subsidised swimming lessons for more than 20,000 children and adults every year from Culturally and Linguistically Diverse and financially disadvantaged communities through the revised Learn to Swim Program.

- Discounted entry to national parks for certain concession holders including pensioners and veterans.

- Fishing licence fee exemptions for Aboriginal persons, youths, and certain concession card holders including pensioners and veterans.

- Transport

- Toll Relief – $60 weekly toll cap eligible private motorists that spend between $60 and $400 on tolls a week can claim a rebate of up to $340 a week, each quarter.

- The M5 South-West Cashback Scheme which enables residents to claim back the value of tolls (excl. GST) paid while using a vehicle registered in NSW for private, pensioner, or charitable use on the M5 South-West Motorway.

- Daily, weekend and weekly Opal Card Travel Caps for adults, children, youths, and concession holders.

- The School Student Transport Scheme which provides subsidised travel to and from school for eligible students on Government and private bus, rail, and ferry services, long-distance coaches, and in private vehicles where no public transport services exist.

- Concessional Driver Licence Renewal fees for eligible concession holders.

- Vehicle registration exemptions for eligible concession card holders including pensioners.

- The Taxi Transport Subsidy Scheme provides a 50 per cent subsidy of a taxi fare, up to a maximum of $60, for eligible NSW residents who cannot use public transport because of a severe and permanent disability.

- Providing a $100 rebate to registered first and second year apprentices through the Apprentice Vehicle Registration Rebate.

- Reducing the cost of towing privately registered caravans, boats, and horse floats on certain toll roads through the Large Towed Recreational Vehicle Toll Rebate for up to eight trips per month.

Further Information

For more information, please contact Hawker Britton’s Managing Director, Simon Banks on +61 419 648 587.

Further Hawker Britton Occasional Papers are available here.